Is Shoreditch Still Cool?: How a neighbourhood becomes a business model

Writer Wills Mayani

Shoreditch didn’t collapse. It professionalised. The numbers, the language, and the leases explain why — and what ‘cool’ costs once attention turns into yield.

In the late 1990s, Shoreditch was cheap. Not cheap as an aesthetic — cheap in the practical sense that makes risk possible. When rent is low and expectations are unclear, people experiment. They open studios that may not survive. They host nights that may not scale. They try things without first asking whether the spreadsheet agrees.

That looseness created culture, but it also created a story.

By the mid-2000s, Shoreditch had become shorthand for something larger than itself. It meant creative density. It meant visible ambition. It meant that if you walked down the right street at the right hour, something might be happening that hadn’t been focus-grouped first. The brick, the shutters, the repurposed warehouses — these were surface details. The real asset was unpredictability.

Narratives, however, reduce uncertainty. And uncertainty is what capital dislikes most.

When the story becomes policy

On 4 November 2010, the government announced plans to turn East London into a technology hub — “Tech City.” The point was not merely investment, but definition. Once a neighbourhood is named as a growth engine, it becomes legible. It acquires a function in the national imagination.

Shoreditch did not change overnight. But the language around it did.

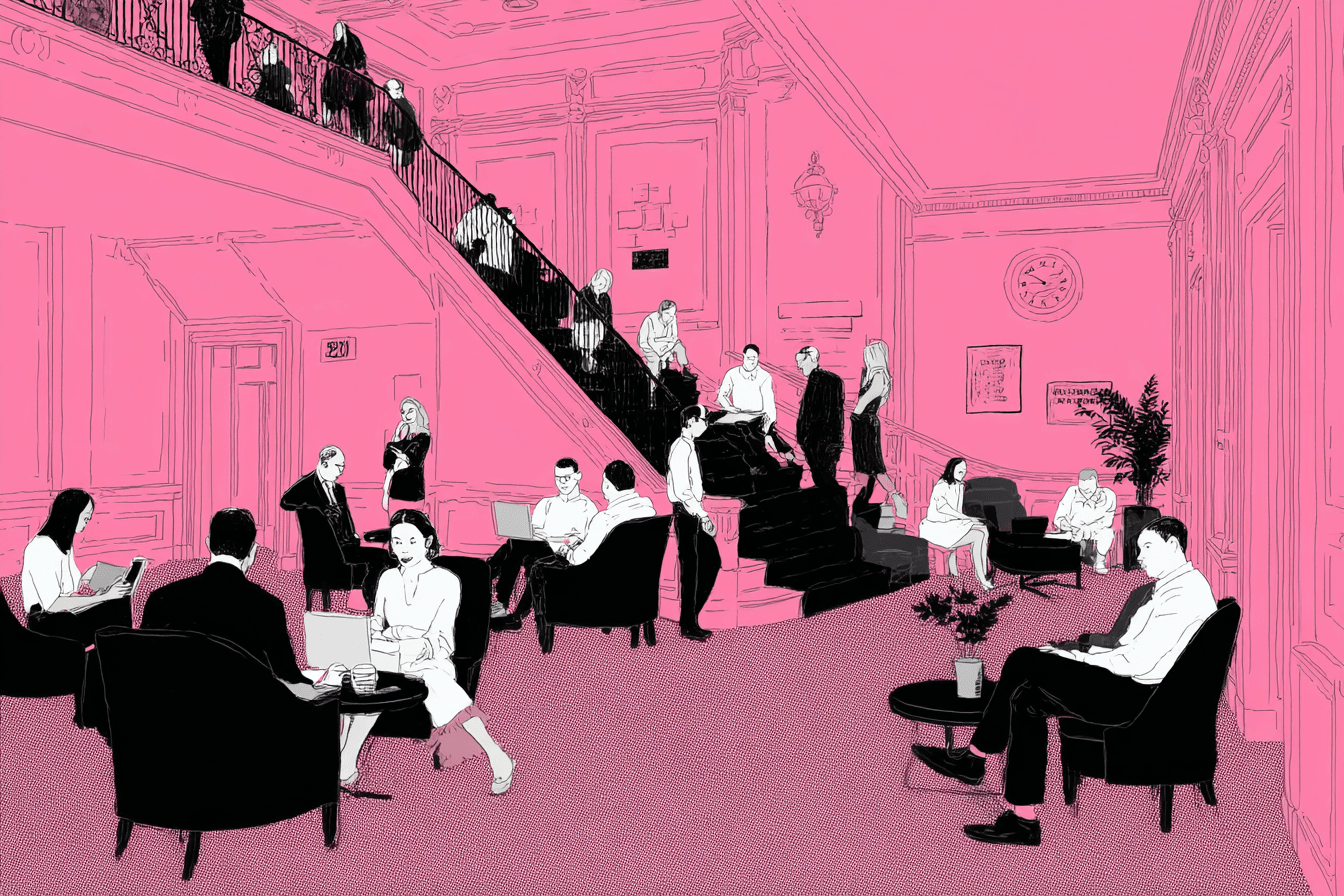

Flexible offices multiplied. Start-ups clustered near Old Street. Co-working became an industry rather than an improvisation. The ecosystem professionalised, and professionalisation carries expectations. Expectations shape rent.

The rent writes the menu

By 2024, Shoreditch was widely cited as one of London’s strongest-performing rental markets in terms of monthly growth, with agency analyses placing average rents up by roughly 6.6 per cent per month across that year. Meanwhile, Office for National Statistics data for Hackney showed average private rents reaching £2,578 in December 2025, rising faster than the London average.

The number itself is less important than what it signals: demand that consistently converts into price.

Cool is often mistaken for aesthetic. In reality, it is economic. It depends on slack. Slack allows people to attempt things that may fail. When slack disappears, experimentation becomes expensive. When experimentation becomes expensive, it becomes selective.

“Cheap space doesn’t create virtue. It creates slack — and slack is where culture shows up first.”

The cafés remain. The bars remain. The murals remain. What shifts are the margins and the lease terms behind them.

Shoreditch, in numbers

Tech City announced: 2010

Average private rent in Hackney (Dec 2025): £2,578

Rental growth cited (2024, agency analysis): ~6.6% monthly

These are not dramatic figures. They are cumulative ones. And cumulative change is what reshapes cities.

Professionalised cool

It is tempting to call this gentrification and leave the argument there. But that word can flatten nuance. Shoreditch has not been replaced. It has been professionalised.

Professionalisation preserves the surface while reorganising participation. Culture remains visible, but it increasingly has to justify itself in commercial terms — as brand, as destination, as scalable concept. The area still produces music, fashion, design, nightlife. What has narrowed is the tolerance for uncertainty.

Office space in Shoreditch now routinely advertises per-desk pricing that would have been unimaginable in the era of half-legal warehouse studios. Flexible workspace providers quote hundreds of pounds per desk per month, sometimes far more, reframing what once felt improvised as premium infrastructure. This is not moral decline. It is market alignment.

When landlords and operators optimise for reliability, the result is a neighbourhood that still looks creative but behaves predictably.

The cost of clarity

In its earlier phase, Shoreditch signalled difference. Now it signals desirability. Difference implies risk; desirability implies validation. The distinction is subtle, but it shapes what gets funded, what gets approved, and who can afford to stay long enough to try something strange.

There are no cartoon villains in this story. Investors follow signals. Councils approve developments that promise tax base and employment. Founders cluster near talent. Each decision makes sense in isolation. Together, they compress the margins in which odd things can happen.

The cafés are full. The offices are leased. The cranes remain part of the skyline. The aesthetic of creativity survives.

Beyond the perimeter of attention, another neighbourhood is currently cheap enough to tolerate risk. That is where the next argument about cool will begin — not because Shoreditch stopped being interesting, but because cities rarely leave slack in the same place for long.

Wills Mayani writes for LocoWeekend. For more, subscribe.