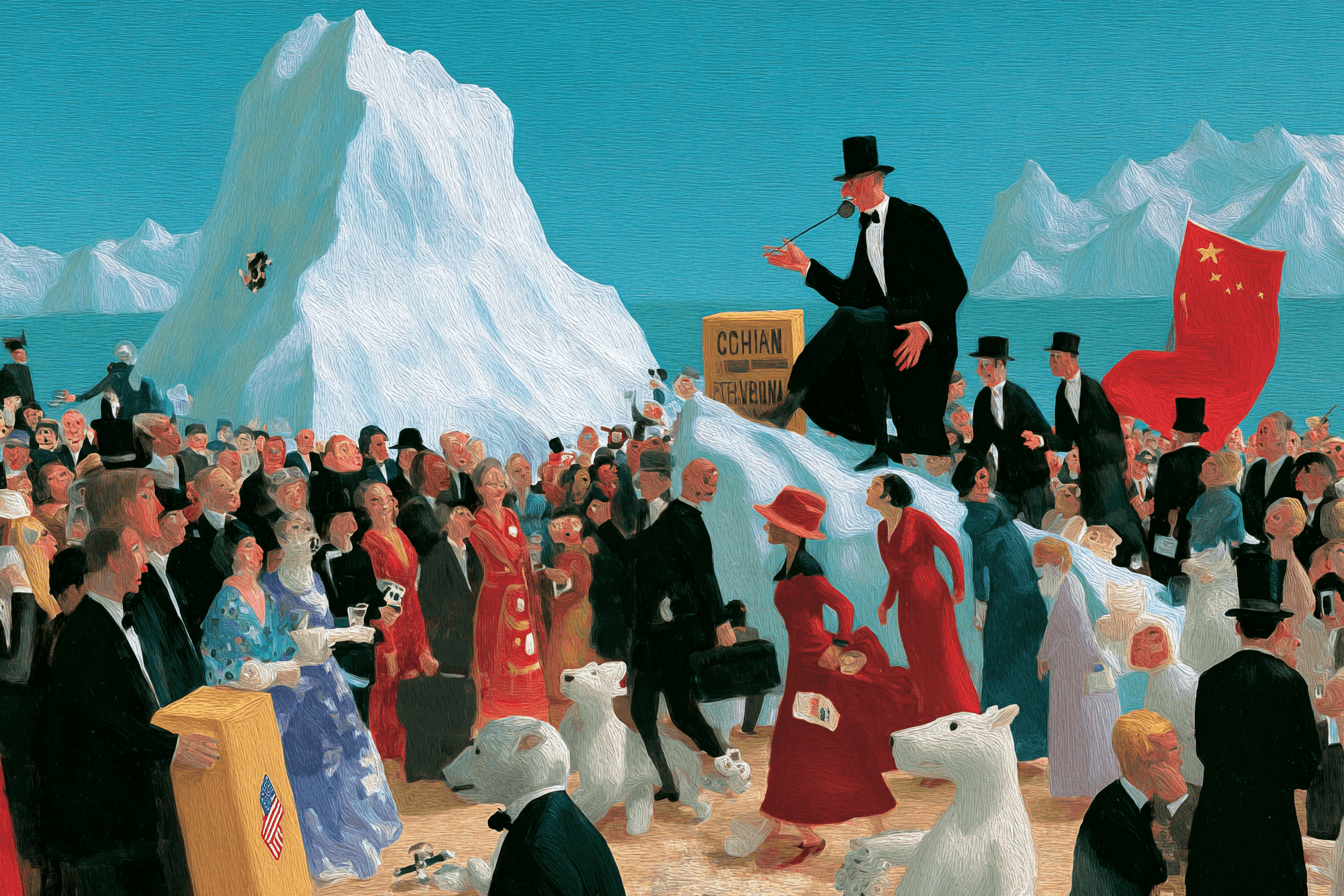

The Passport Economy: Why citizenship, tax, and geography are becoming business decisions

Writer Wills Mayani

Residency visas, tax arbitrage and mobility incentives have turned nationality into strategy. In 2026, where you live is less about identity and more about optimisation.

For most of modern history, citizenship was not a choice. It was an inheritance. You were born somewhere, paid taxes somewhere, and built your life within a system that assumed relative permanence. Migration existed, of course, but it was shaped by labour, conflict, or family. It was rarely framed as optimisation.

That framing has shifted.

In 2026, geography is increasingly treated as a variable. Founders compare tax regimes before incorporation. Investors assess residency status before exits. Remote workers evaluate visa pathways with the same logic they once applied to job offers. Nationality has not lost its symbolism, but it has acquired a second function. It has become infrastructure.

More than fifty countries now offer digital nomad visas. The list includes places as varied as Portugal, Spain, Estonia, the United Arab Emirates, Costa Rica and Thailand. These programmes are not cultural exchanges. They are economic instruments designed to attract mobile income without necessarily importing local wage competition. The pitch is direct. Bring your remote salary, spend locally, benefit from favourable tax treatment.

The United Arab Emirates does not levy personal income tax. Italy introduced a flat tax regime for high net worth individuals relocating their fiscal residence. Greece followed with its own incentive. Portugal’s Non Habitual Resident regime, before being scaled back, drew thousands of foreign professionals with reduced tax on foreign sourced income. These are not fringe experiments. They are coordinated signals that mobility is welcome, provided it arrives with liquidity.

The golden visa decade made the shift explicit. Between 2011 and 2023, European residency by investment schemes generated billions in foreign capital. Portugal reportedly attracted over six billion euros through its programme before tightening eligibility. Greece and Spain built property driven pathways to residency. Malta offered citizenship routes that later drew scrutiny from Brussels. The underlying message was clear. Access to a passport could be structured.

Critics described these schemes as commodifying belonging. Supporters argued they revitalised property markets and public finances in the aftermath of financial crisis. Both interpretations coexist. What changed was not only policy but psychology. Citizenship, long treated as sacred, revealed a price.

Tax strategy, once the preserve of multinationals, has filtered downward. Large corporations spent decades routing profits through Ireland or the Netherlands. Today, individuals do something similar with residency. In the United Kingdom, the non dom regime historically allowed certain residents to shield foreign income from domestic taxation, a policy now under political pressure. In contrast, territorial tax systems such as those in Singapore or the UAE tax income where it is earned rather than globally. For founders approaching liquidity events, these distinctions are not academic. Relocation before an exit can alter outcomes by millions.

Remote work accelerated the logic. When offices lost their monopoly over productivity in 2020, location became less constraint and more preference. By 2023, millions of knowledge workers operated remotely at least part time. Entire companies shifted to distributed models. Cities responded accordingly. Lisbon marketed lifestyle and weather alongside residency pathways. Dubai positioned itself as a zero tax base with global connectivity. Singapore reinforced its role as a stable gateway to Asia. Miami leaned into technology and crypto capital. Each offered not just culture, but fiscal positioning.

For high net worth individuals, multiple residencies and second passports have become a form of insurance. Investment migration consultancies speak openly about political diversification. The language echoes portfolio theory. Exposure to one jurisdiction is balanced by optionality in another. If tax law changes, if political risk increases, if capital controls tighten, mobility reduces vulnerability. The passport becomes less a statement of identity and more a hedge against uncertainty.

There is an unease in this evolution. States still fund infrastructure locally. Schools, healthcare systems and transport networks rely on tax bases that presume attachment. When the most mobile taxpayers relocate strategically, the arithmetic shifts. In Lisbon, residents protested rising rents as foreign remote workers with higher purchasing power arrived in concentrated numbers. Property prices in parts of southern Europe surged during the height of golden visa demand. In Britain, debates around non dom taxation reflect broader questions about fairness and contribution.

Mobility is not evenly distributed. For some, borders remain rigid. For others, they are negotiable. Airports now contain biometric fast lanes and private terminals. Incorporation can be completed online. Banking relationships can be established across jurisdictions. The difference between constraint and choice often maps directly onto capital.

What makes this moment distinct is not that people move. It is that movement has been reframed as rational optimisation. Relocation is discussed in podcasts and founder forums without embarrassment. Consultants advertise jurisdiction comparisons with the neutrality of financial advisers. The vocabulary is managerial rather than emotional. One does not leave a country. One restructures.

The passport economy does not dissolve nation states. It alters the assumptions beneath them. Social contracts were built on relative immobility and shared fiscal exposure. If belonging becomes conditional, anchored primarily to incentive, the idea of shared fate weakens. That does not mean it disappears, but it competes with spreadsheet logic.

Geography has become competitive product. Residency is packaged with tax relief, lifestyle branding and regulatory clarity. Citizenship sits somewhere between insurance and asset. The modern founder no longer asks only where opportunity exists. They ask where it is most efficient to exist.

Somewhere in the background of these decisions, often unspoken, is a quiet recalculation. Not where do I belong. But where am I optimised.

Wills Mayani writes for LocoWeekend. For more, subscribe.