The Subscription Trap: How recurring revenue changed human behaviour

Writer Wills Mayani

From streaming platforms to razor blades and AI tools, recurring billing has reshaped spending habits. Convenience became commitment. Commitment became default.

When ownership quietly disappeared

There was a time when buying something implied a conclusion. You entered a shop, exchanged money and left with an object that was unequivocally yours. A stack of compact discs. A boxed copy of software sealed in plastic. A newspaper that, once read, could be folded and kept or discarded at your discretion. Even functional purchases — printer cartridges, razor blades, a gym membership paid in cash at the desk — carried the psychological clarity of finality. The transaction had edges. It began and it ended.

Over the past two decades those edges have softened, not through rupture but through gradual reframing. Music migrated from shelves to servers; software from install discs to cloud dashboards; films from rental counters to endlessly scrolling catalogues. Increasingly, even physical goods arrive not as singular purchases but as replenishing services. Cars offer features that activate only while a payment remains active. Storage space, design tools, fitness classes, language lessons and meditation libraries now exist within the same financial architecture: recurring access in exchange for recurring fees.

Ownership did not disappear overnight. It diluted into access, and access renews by default.

The rise of the invisible debit

The transformation is visible not in shop windows but in bank statements. Scroll through a modern banking app and a pattern emerges: modest charges appearing with quiet regularity. £4.99. £8.99. £12.00. £19.99. Individually, each sum feels tolerable; collectively, they form a persistent undercurrent. Because the amounts are small and automated, they rarely provoke the deliberation that once accompanied a purchase. They become background noise — a low hum of participation in contemporary life.

The subscription model succeeds not merely because it generates reliable revenue for companies but because it reduces the cognitive burden of decision-making for consumers. The question of value — “Is this worth paying for?” — is compressed into a single moment at sign-up. Thereafter, continuation requires no action. Cancellation, by contrast, demands initiative. Behavioural economists have long documented the power of defaults; when inaction results in renewal, renewal becomes statistically inevitable.

In this sense, recurring billing is less a technological breakthrough than a behavioural one. It transfers effort to the point of exit. Many never reach it.

How the monthly mindset took hold

The technology sector institutionalised this logic first. Software once purchased outright evolved into “Software as a Service,” reframing tools as continuously improving utilities rather than static products. Adobe’s Creative Cloud replaced boxed editions. Microsoft pivoted to 365. Updates became perpetual, and so did payment. What had been episodic expenditure turned into operational overhead.

Entertainment followed. Spotify rendered digital downloads redundant. Netflix recalibrated the idea of ownership by presenting cinema as an infinite, rotating library rather than a collection of titles acquired one by one. Cloud storage normalised the idea that personal files reside in rented space. From productivity platforms to AI assistants, the subscription cycle extended across categories with remarkable speed.

The shift was subtle but profound. Consumers ceased to evaluate purchases in isolation and instead began to assess whether a service belonged within their “monthly stack.” The language itself changed: subscriptions were not bought but managed. The calendar became the organising principle of consumption.

The arithmetic of accumulation

Part of the model’s durability lies in perception. A single payment of £120 registers as significant; a monthly charge of £10 feels comparatively modest, even though the annual cost is identical. Over multiple years, the cumulative expense of subscription frequently exceeds the price of an equivalent one-off purchase. Yet human cognition privileges immediate affordability over long-term arithmetic. The monthly figure aligns neatly with salary cycles and bill schedules, encouraging consumers to anchor to manageable increments rather than aggregate totals.

Pricing structures reinforce this bias. Monthly plans are foregrounded; annual commitments are framed as prudent savings; lifetime access, when offered, appears anomalous. Across multiple services, the incremental logic compounds. A household with a dozen active subscriptions may not consciously calculate the total, though the sum rivals more traditional fixed expenses.

The outflow occurs in fragments, and fragments rarely trigger alarm.

From product to infrastructure

For investors and executives, recurring revenue offers a different appeal: predictability. Regular income smooths volatility, improves forecasting and commands higher valuations. Metrics such as monthly recurring revenue and churn rates become central indicators of corporate health. Businesses that secure long-term subscriber bases are rewarded more generously than those reliant on sporadic transactions.

This financial incentive reshapes product design. Free trials convert automatically unless interrupted. Cancellation processes are legally compliant yet strategically inconvenient. Discounts reward longer commitments. Loyalty schemes gamify retention. The subscription becomes not only a billing mechanism but an organising principle for development.

Over time, the model begins to resemble infrastructure. Streaming platforms, productivity suites and cloud storage solutions occupy positions once reserved for utilities. They are no longer perceived as discretionary purchases but as necessary components of participation in professional and social life.

When products evolve into infrastructure, opting out feels less like a choice and more like a disruption.

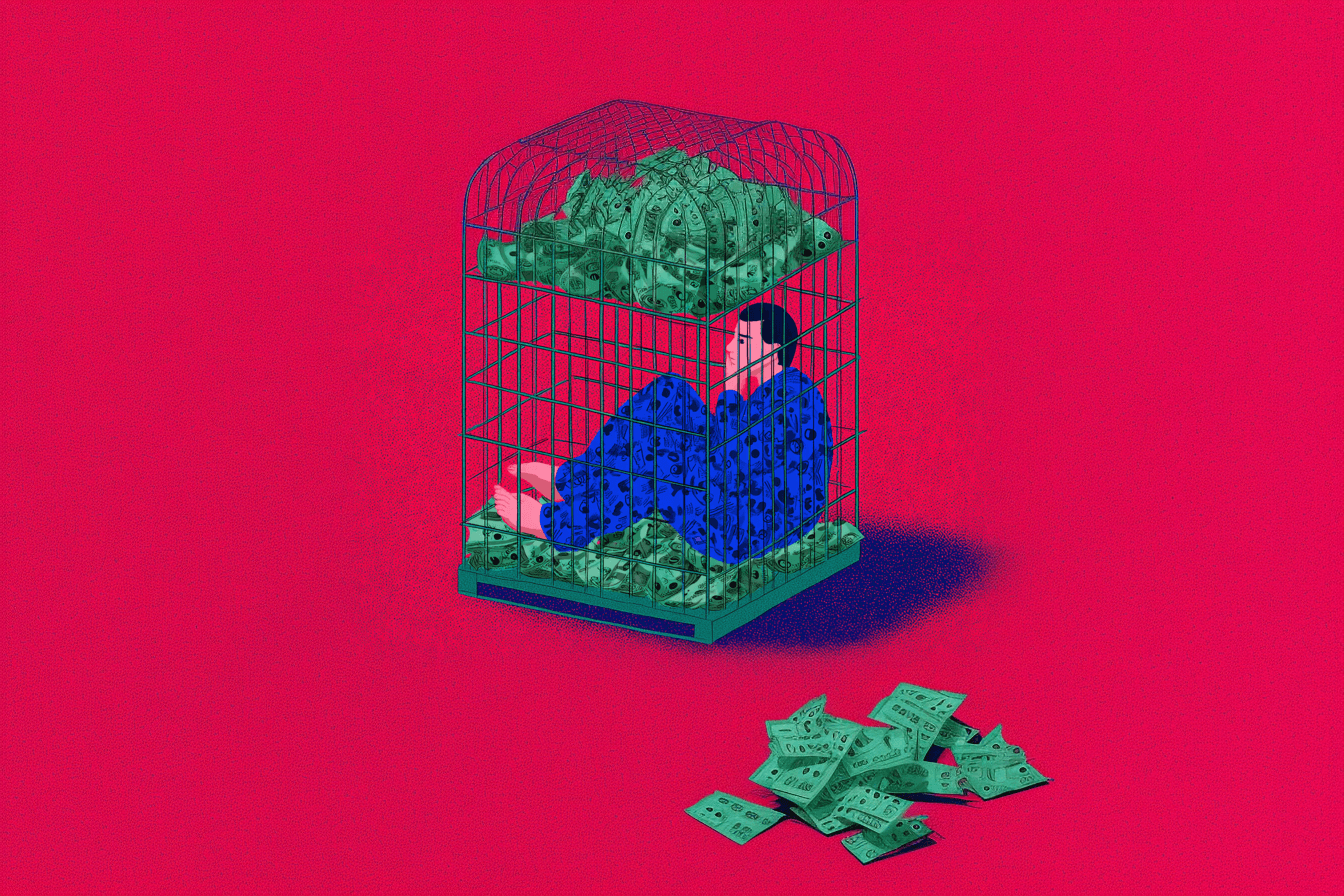

Access and its dependencies

The subscription economy is not without its merits. It lowers barriers to entry, enabling small businesses and independent creators to access sophisticated tools without prohibitive upfront costs. It provides sustainable revenue streams for journalism, entertainment and niche services that advertising alone might not support. It allows experimentation without substantial capital commitment.

Yet access carries its own conditions. If payment lapses, access ceases. Files stored in the cloud remain conceptually yours but practically inaccessible. Media libraries curated over years can vanish when licensing agreements change. Tools disable themselves in the absence of renewal. The relationship between income and functionality becomes continuous.

Ownership once implied insulation; access requires maintenance.

Inertia as strategy

A further dimension of the subscription model lies in its reliance on partial engagement. Many services persist not because they are used daily but because they are used occasionally — or because they might be used in future. A gym membership can remain active despite sporadic attendance; a streaming platform may justify itself through a single anticipated release; a productivity app lingers on the basis of potential utility.

This inertia is not accidental. It is embedded within the economics of subscription. Low-friction renewal combined with moderate pricing encourages passive retention. Entire secondary industries now exist to counteract this effect: applications that catalogue recurring payments, services that negotiate cancellations on behalf of users and banks that visualise subscription expenditure to prompt reconsideration. The emergence of these tools suggests that the architecture of convenience has become sufficiently complex to require navigation aids.

When friction migrates from purchase to cancellation, behavioural momentum favours continuation.

The recalibration underway

Recent economic pressures have introduced a measure of reassessment. Households facing tighter budgets scrutinise recurring costs more closely, prioritising some services while rotating others. Streaming platforms observe patterns of cancellation and reactivation as consumers move strategically between catalogues rather than maintaining simultaneous loyalty. Regulators in several jurisdictions have mandated clearer cancellation procedures and more transparent renewal disclosures, signalling a growing awareness of the asymmetry between enrolment and exit.

Companies respond with adaptation rather than retreat. Bundled offerings combine multiple services under a single fee. Annual plans promise savings in exchange for extended commitment. Ecosystems deepen, integrating communication, storage, productivity and entertainment into unified environments that make departure increasingly inconvenient.

Beneath these tactical adjustments lies a broader cultural consideration. As payment becomes continuous and automatic, the distinction between deliberate expenditure and ambient obligation narrows. The subscription model has reshaped corporate balance sheets, but it has also reshaped the cadence of personal finance. Spending is no longer episodic; it is sustained.

Continuity, while efficient, subtly alters the experience of control.

The return of edges

There remains, nonetheless, an enduring appeal in transactions that conclude. Purchasing a book outright, acquiring a tool without future obligation or paying once for access that does not expire provides a clarity absent from indefinite renewal. Finality carries psychological reassurance: the sense that an exchange has been completed rather than deferred.

The subscription economy is unlikely to recede entirely. It aligns seamlessly with digital infrastructure, investor expectations and the convenience sought by modern consumers. Yet its dominance has consequences that extend beyond revenue models. In smoothing the friction of repeated decision-making, it has also reduced moments of reflection.

Convenience reshapes behaviour quietly. Commitments extend without ceremony. Payment becomes part of the background architecture of daily life.

Whether that architecture enhances autonomy or gradually constrains it remains an open question. What is certain is that recurring revenue has changed not only how companies earn but how individuals relate to what they use. Ownership has not vanished, but it no longer defines the default. Access does — and access, by design, does not end unless we make it.

Wills Mayani writes for LocoWeekend. For more, subscribe.